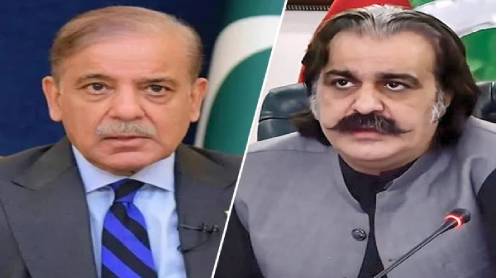

Prime Minister Shehbaz Sharif ordered on Monday to immediately disburse Rs50 billion to the Chinese power producers to save them from default and also open a revolving fund to protect them from the circular debt in future.

The premier gave the instructions during a meeting with Chinese investors who for the past few years had been trying to secure their rights guaranteed under the China-Pakistan Economic Corridor (CPEC) framework agreement.

The prime minister assured the Chinese investors that all the commitments made by the previous government would be honoured, said Ahsan Iqbal, Minister for Planning and Development, while talking to The Express Tribune.

Iqbal said that the PM directed that Rs50 billion should be disbursed by Thursday and a revolving fund should be opened before July.

It is not for the first time that such instructions have been given from the highest level. Earlier, the previous government had got a summary approved from the Economic Coordination Committee (ECC) in February this year to make arrangements for setting up revolving funds backed by sovereign guarantees to ensure uninterrupted payments to the Chinese sponsors of energy projects.

Under the arrangement, a revolving account equal to 22% of monthly invoicing will be opened and maintained by the power purchaser for which the Ministry of Finance will provide the guarantee to fund such a revolving account in case the power purchaser fails to place and maintain the required fund in such account.

The last government had decided to open the account days before the then PM’s visit to China but subsequently stopped the process after the end of the visit.

As a result, the payments to the Chinese power producers have surged to Rs340 billion coupled with the Central Power Purchasing Agency-Guarantee’s (CPPA-G) decision to pause further payments to the Chinese independent power producers (IPPs).

The PM also addressed the Chinese investors. “The PM’s speech gave us hope and confidence,” said an official of a Chinese company.

Shehbaz Sharif noted that the power plants helped overcome load-shedding and supported industrial production, lifted exports and generated employment opportunities.

A few months ago, Pakistan made a payment of Rs50 billion to the Chinese IPPs but blocked the processing of another Rs50 billion besides backtracking from its fresh commitment to open the Escrow account.

Finance ministry sources claimed that the International Monetary Fund (IMF) had raised certain objections to the payment of Rs50 billion to the Chinese without any budgetary provision.

If Rs50 billion payment is not immediately processed, the power projects of CPEC will face further risk of default on the upcoming debt repayments.

Official documents showed that 11 Chinese power companies were facing serious issues due to the mishandling of their investment by the Pakistani authorities.

Of these, eight IPPs were waiting for the clearance of their cumulative dues of Rs340 billion to cover the cost of power generation. Even after clearing Rs50 billion, the Chinese investors’ receivables would stand at Rs290 billion.

Ahsan Iqbal said that the last government destroyed CPEC and it could not even pay the Rs50 million annual dredging maintenance cost and as a result no big ships could dock at Gwadar Port. “Only small ships can dock at Gwadar Port,” he added.

Due to the mishandling by the previous Punjab government, the Chinese sponsors of the Lahore Waste Management Company have taken Pakistan to international arbitration, according to the sources.

The coalition government has now made Rs630 million payment to the Chinese firm, a day before the hearing of the case to avoid any embarrassment.

Sources said that the prime minister on Monday directed to also address the issue of visas on a priority basis.

In his televised address, Shehbaz Sharif stressed that Pakistan needed support from China in the form of investment, trade and transfer of knowledge rather than the disbursement of loans and financial aid.

In a meeting with Chinese investors, he said that Pakistan wants to learn agriculture and industrial uplift and cost cutting from China.

Official documents showed the 1,320-megawatt Port Qasim power plant faces the immediate challenge of clearing $83 million worth of debt, including $70 million in principal loan repayment on May 31.

The government owed Rs91.2 billion to the Port Qasim power plant that has created serious liquidity problems for the firm. The plant, in turn, owes $140 million to the coal supplier.

Documents showed that Pakistan owed Rs96.4 billion to the 1,320MW Sahiwal coal-fired power plant. The company faces the issue of low payments for coal transportation and the royalty fee charged by the Port Qasim Authority.

Receivables of the 1,320MW Hub coal power project, set up by China Power Hub Generation Company Limited (CPHGC), have increased to Rs71.6 billion, according to the official documents.

The UEP 100MW power plant is also facing the default scenario due to its outstanding dues of Rs4.3 billion.

The 100MW Three Gorges wind power project is experiencing similar problems due to its outstanding dues of Rs4.1 billion.